4: Treasures Underground

- Page ID

- 8294

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)Natural resources found underground have been important throughout American history. As discussed earlier, extracting wealth from the newly-discovered continent was one of the earliest motivations for the Europeans who invested their time and wealth in the New World. Natives of North and South America already used gold, silver, and copper to make tools and ornaments, and European explorers from Europe confiscated the riches of native cities and speculated about hidden cities of treasure like the legendary El Dorado. The wealth they did find transformed European, Asian, and later American economies and helped create a global economy where borders are porous to the treasures found underground.

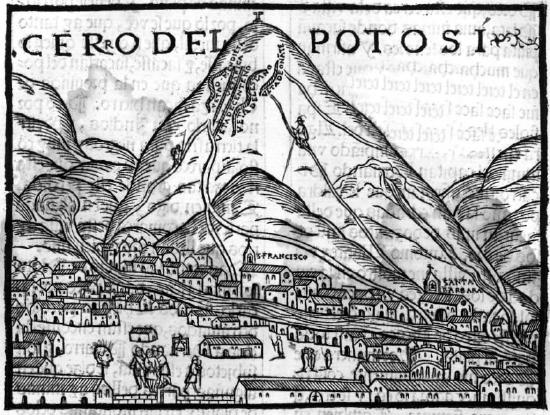

The Spanish Imperial City of Potosí in what is now Bolivia was the site of the largest silver lode discovered in the Americas, which has turned out to be the largest in the world. The city was built in the mid-1500s on top of an earlier Indian mining village in the shadow of a mountain the Spanish dubbed the Cerro Rico (or rich mountain). The Cerro Rico has been mined continuously for five hundred years and is still producing silver. By the early 1600s Potosí’s population exploded to 160,000 Spanish colonists and nearly 15,000 Indians forced to work in the mines in a mandatory labor system called the mita originally developed by the Inca Empire and continued by its Spanish conquerors. After silver ore was removed from tunnels in the Cerro Rico, it was processed using a technique involving grinding and mercury amalgamation. The ore was crushed in 140 ingenios or mills operated with water power from 22 reservoirs, mixed with mercury, and the slurry was baked in kilns to separate the silver. Workers stamped bars of the precious metal with the mark of the Spanish Royal Mint and carried them by mule trains to Panama to be shipped to Seville.

The Cerro Rico is a volcanic dome rising about a half-mile over the city which stands at an altitude of over 13 thousand feet. Conditions in the mines were harsh and mercury poisoning from the vapors of the kilns caused weakness, poor coordination, kidney disease, and ultimately death. Due to the strenuous work they do in the thin atmosphere, most natives had to chew coca leaves to counteract altitude sickness. But the mountain’s wealth was a potent motivation and during the second half of the 16th century, Potosí produced 60% of all the silver mined in the world and the Spanish Empire depended on the Cerro Rico’s constant flow of revenue. When there were no longer adequate numbers of Indians to fill the mita, colonial mine owners began importing African slaves, who also died in large numbers. After Bolivian independence in the early 19th century slavery was outlawed, but labor conditions have remained harsh to the present day. Even in modern times, the average life expectancy of a Potosí silver miner is only about 35 years, due to silicosis. The Cerro Rico is known locally as “the mountain that eats men,” but in the past 500 years Potosí has produced over 60 thousand metric tons of silver.

The Spanish Empire was not as successful finding gold in the Americas as it had been finding silver. Although conquistadors managed to loot the Aztec and Inca Empires of their treasures, many of the most important American gold mining breakthroughs were made centuries later. Gold was first discovered in the United States in the 1790s, when several large nuggets weighing up to 28 pounds were discovered in North Carolina. In the late 1700s and early 1800s, North Carolina mines produced all the gold sent to the US Mint until 1829 when Virginia, Georgia, and Alabama began producing small quantities. The discovery of substantial amounts of gold in 1848 and 1849 in California created America’s first gold rush. It is unclear whether the American government was completely unaware of the possibility of finding large quantities of precious metals in the West when the nation went to war against Mexico in 1846, but in the treaty ending the Mexican-American War of 1846-1848, the US acquired territory that became California, New Mexico, Arizona, Nevada, Utah, Wyoming, and Colorado.

Unlike the Spanish Empire, which had controlled mineral production through a longstanding legal tradition that reserved ownership of subsurface resources for the nation rather than allowing individual ownership of mines and their products, the United States created a property ownership system that included subsurface as well as surface assets. Title to mineral claims in the US was validated primarily by proof of discovery and by persistence. That is, a prospector could claim the land and the minerals beneath it if he could prove he had discovered and consistently worked the claim. A rush of migration following news of the discovery at Sutter’s Mill on the American River west of Sacramento resulted in California statehood in September 1850. In 1849 alone, California gold mines produced three times the $15 million payment the US given Mexico for the entire territory. After the new territory’s population doubled in less than a year, California became the 31st state in September 1850. Congress accepted California under the terms of the Compromise of 1850, which although it created the Bloody Kansas controversies of the 1850s, probably helped the Union win the Civil War. Under the Compromise of 1850, California entered the United States as a free state in return for concessions to strengthen Southern slavery. But when the Civil War began in 1861, California’s mines delivered gold to the US Treasury throughout the conflict, sending $186 million between 1861 and 1864. To better connect California with the Union, the Lincoln administration rushed legislation through Congress authorizing transcontinental railroads and granting the Union and Central Pacific Corporations large amounts of public land, as we have seen.

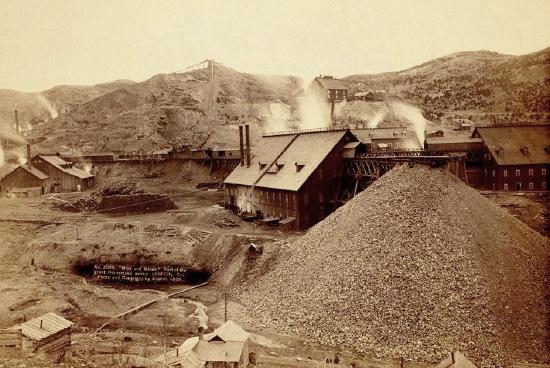

The silver that supported the Union cause came primarily from Nevada, where the Comstock lode, developed in the last years of the 1850s, had quickly shifted from the hands of its original discoverers to well-financed corporations run by investors like George Hearst. Nevada is still the second-largest silver producer in the US, after Alaska. The Comstock Lode was discovered in 1859 in western Nevada and quickly fell under the control of Hearst, who later developed the Ontario silver mine, discovered in 1872 in northern Utah. Hearst went on to invest in the Homestake gold mine in the Black Hills of South Dakota and the Anaconda copper mine in Montana. The Homestake mine, discovered in 1876, operated until 2002 and became the second largest gold producer in North America as well as the world’s largest and deepest gold mine. Hearst originally bought the Anaconda mine in Butte Montana as a silver mine in 1881, but after high-grade copper ore was discovered there, Butte became known by locals (who had apparently never heard of Potosí) as the “richest hill on Earth.” From 1892 to 1903, the Butte Anaconda mine was the world’s leading copper-producer.

By the early twentieth century, American mining companies had become highly capitalized corporations. Homestake, for example, was first listed on the New York Stock Exchange in 1879, making it the first mine listed and one of the longest-listed stocks in the Exchange’s history. Homestake was bought by the Canadian-based Barrick Gold Corporation in 2002. Anaconda profited from copper’s increasing value with the development of electrification, and the company fought off a takeover bid by the Rothschild international banking conglomerate by allying with the Standard Oil Company. In the early 1920s, Anaconda began acquiring mines in Mexico and Chile. In 1923 Anaconda bought the Chuquicamata mine in northern Chile from the Guggenheim family of New York. The legendary “Chuqui” was the world’s largest copper mine throughout the twentieth century and has been an important factor in Chile’s history and in the story of American intervention in that history. We will consider the involvement of American corporations in resource extraction, and in Chilean copper mines, shortly.

North American copper was widely used by pre-Columbian natives, who found the metal in large deposits in what is now northern Michigan and beat it into ear pendants, necklaces, bracelets, knives, and arrowheads. Copper items became widely used by Indians and were carried over a surprisingly wide trade network. Explorer Sebastian Cabot wrote in 1497 that the native people of Newfoundland used “a great plenty of copper,” and Giovanni Verrazzano reported that among the Indian residents of Nantucket Island, copper was valued higher than gold. On the other side of the continent, Russian explorers in what is now Alaska found natives using copper knives in the 1740s.

Although they did not possess the types of smelting and forging technologies that Europeans and Asians had developed by the time they began colonizing the Americas, there is ample evidence that native Americans mined gold, silver, and copper, and even used coal for cooking in the centuries before their first contact with Europeans. Most of the copper now mined worldwide comes out of the ground in ores that need extensive processing, but Michigan copper was unique. Indians and later European prospectors discovered rich veins of metallic copper that did not require processing. In some cases, miners found boulders of solid copper weighing several tons. One large copper outcropping reported by a British trader in 1766 was estimated at five tons and was surrounded by old stone tools and cut marks where pieces had been chopped away. The British trader wrote that “such was its purity and malleable state, that with an axe I was able to cut off a portion weighing a hundred pounds.” When miners finally dug up the entire “Ontonagon” copper boulder and sent it to the Smithsonian Institution in 1843, it still weighed 3,708 pounds. In addition to the remote copper deposits of Michigan, in the 1710s Dutch colonists rediscovered a smaller vein of copper ore in New Jersey (old hammers and tools found at the site suggest the vein had also been worked even earlier by colonists). By the 1730s, the output of this New Jersey vein was 1386 tons, in spite of the fact that the colonists were not allowed to smelt ore and refine the copper. Instead, the ore was packed in barrels and shipped to Bristol England for processing.

In spite of their initial failure to discover great caches of precious metals, English colonists in North America continued trying to develop mineral resources. In 1619 the London Company sent 153 iron-workers to Virginia to develop three discoveries. Work began on the largest site, 32 miles inland on a branch of the James River, in 1620. A year later twenty additional experienced workers were sent to the new mine, under the direction of an English aristocrat named John Berkeley. Although these miners made progress, Indians attacked the iron-works in 1622 and killed 347 workers there, including Berkeley. The operation was completely destroyed. Two decades later, John Winthrop Jr., the son of the Massachusetts Colony’s governor, organized a company to develop the iron ore discovered in bogs around the town of Lynn. When the younger Winthrop became governor of Connecticut in 1657, he began an iron-works in New Haven. Smelting of bog-ore continued in Middleborough Massachusetts along with the forging of nails – until another Act of Parliament prohibited smelting in the colonies to support industry in England. This protectionist measure was resented by the colonists and probably helped fuel the Revolutionary cause.

By 1810 production of iron in the new United States was valued by the Treasury Department at $13 million, more than three times the iron Americans imported. The Treasury’s report counted over 500 forges in the new nation, and to protect the fledgling industry the first tariff on iron imports was levied in 1816. The first large deposit of iron ore in the Lake Superior region was reported in a letter written in 1840 by Douglass Houghton, Michigan’s first state geologist. This discovery was corroborated in 1844 by a survey party whose compass needle was attracted by a large mass of iron ore. And in 1845, a local Indian chief named Manjekijik led a prospecting party to what the prospectors described as a “mountain of solid iron ore, 150 feet high [and] as bright as a bar of iron just broken.” In return for his help, the chief was promised a substantial share of the mining company’s stock. This bounty was never paid and the chief died in poverty.

The first blast furnace was built to process Michigan ore in 1858 and the Civil War greatly accelerated development of Michigan iron for use in the Union’s war effort and for the building of railroads. Development of coal resources also accelerated the production of iron. As mentioned earlier, coal had been used by Indians for cooking, and early missionaries and explorers wrote frequently of Indians “making fire with coal from the earth” in the seventeenth century. The missionary explorer Father Louis Hennepin reported visiting an Indian mine by the Illinois River in 1679. Coking of coal to increase its effectiveness began in the 1840s using vast anthracite coal deposits discovered in western Pennsylvania, which helped Pittsburgh become a center of steel production in the late 1850s. Pittsburgh steel producers introduced a number of technological improvements to the process, including coke-fire smelting in 1859 and the Bessemer process for removing impurities by oxidation in 1875. By the beginning of the 20th century, Pittsburgh was the center of a steel-producing area that produced a quarter of the nation’s railroad track and nearly two thirds of the structural steel used in construction.

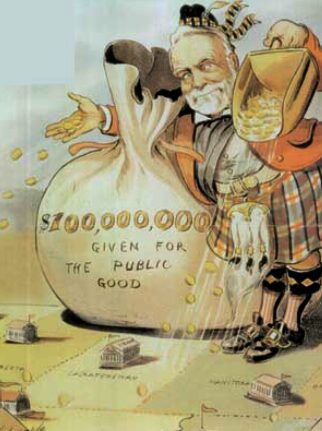

By the late 1880s, Carnegie Steel was the world’s largest producer of pig iron, steel rails, and coke. In 1883, Andrew Carnegie bought rival Homestead Steel Works and in 1892, he launched the Carnegie Steel Company. In 1901, when the sixty-six year old Carnegie was preparing for retirement, he was approached by Wall Street banker J.P. Morgan. Morgan paid Carnegie $250 million for his business and combined it with several others to create U.S. Steel, the world’s first corporation with a market capitalization over $1 billion. Carnegie, who believed that “a man who dies rich, dies disgraced,” devoted much of the rest of his life to giving his wealth to philanthropic causes including over 3,000 public libraries he established in the U.S., Canada, and throughout the English-speaking world. By the time of his death in 1919, Carnegie had distributed over $350 million; his remaining $30 million was given to a variety of foundations and charities.

Mining and the West

Historian Patricia Nelson Limerick summed up the opinions of generations of historians when she said “no industry had a greater impact on Western history than did mining.” Mining introduced westerners to an entrepreneurial ideal, but also to an expectation of making extreme profits—often with little effort. Many Americans looked to the West as a source of easy wealth, which led hundreds of thousands of young men and women to throw caution to the wind and rush out to the California Gold Rush or to Virginia City or Pikes Peak, and later to the Yukon. But as Limerick observed, mining changed rapidly from an individual enterprise where average people could become rich by luck and hard work, to a highly capitalized industrial business. Far from being a refuge from toiling for wages in factories, western mines created a new industry of mineral extraction and processing. In fact, mines featured the same combination of expensive capital and interchangeable wage labor as the textile factories of Massachusetts. However, as many who migrated to the mining frontiers found to their distress, there were fewer employment alternatives for disgruntled workers in mining regions. Many unsuccessful prospectors found themselves in debt for supplies, lodging, and food, and trapped in low-paying jobs until they could save enough money for a ticket back to “civilization.” The unique element that mining retained, however, was what Limerick called the “mood” of extractive industry, which she described as “get in, get rich, get out.”

Many young prospectors were excited by tales of the quick money that could be made panning and working easy-to-obtain placer claims, where extraction amounted to little more than picking up ore lying around on the surface. Thousands succumbed to the “fever” and rushed West, only to find themselves stranded in California without enough money to return home. After several years of hard work for low wages, some men earned enough to return home. In the meantime, many felt themselves to be “in the condition of convicts condemned to exile and hard labor.” And as the first phase of placer collection gave way to a second phase of hydraulic or underground mining, the advantage quickly shifted to corporations that controlled capital and technology and could coordinate the efforts of wage workers. Power transferred to corporations with access to eastern capital and large labor forces. People who had flocked to the goldfields in hope of windfalls found themselves working for wages under conditions every bit as demanding as the urban factory workers they had left behind.

Mining was very dangerous work, but miners were generally not compensated for the risks they took and rarely taken care of when accidents happened. The courts used the principal of “assumed risk” to rule that mining companies bore no responsibility for injured workers because the workers presumably had known the job was dangerous when they took it. The court’s assumption that workers could refuse tasks they considered too dangerous may have been deliberately naïve, but labor unions did not have the power to challenge mine owners in the courts. Mining companies took advantage of a “lag of perception” in which “the old times of individual opportunity still set basic attitudes, and the new times of corporate centralization of power still waited for recognition.” In other words, the myth of prospectors taking risks in order to get rich was used as cover for corporations to subject wage-workers to danger and harsh conditions. Another area where the ongoing myth of a Wild West of easy, democratic resource exploitation was used to benefit mining corporations was the anti-environmentalist idea expressed by a mining executive who said of future generations, “those who succeed us can well take care of themselves.”

Petroleum

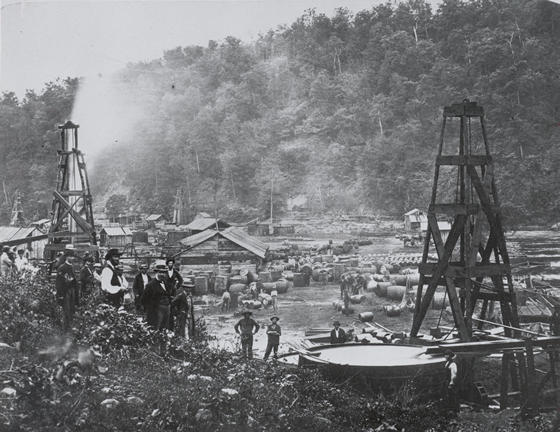

The word petroleum comes from Latin root words meaning “rock” (petram) and “oil” (oleum), to distinguish it from plant or animal based oils. As we’ve already seen, before the development of the petroleum industry, both whale oil and ethyl alcohol were burned as fuels. As mentioned earlier, the petroleum industry in America began in 1859, when George Bissell and Edwin L. Drake drilled the first commercial oil well in Titusville Pennsylvania at a site known as Oil Creek. These weren’t the world’s earliest oil wells, however. The very first oil wells were drilled by Russian engineers in the Aspheron Peninsula on the west side of the Caspian Sea near Baku Azerbaijan, beginning about 1848. American attempts to drill for natural gas had begun in the 1820s, in Chautauqua County New York. After the success of the Titusville well, oil was drilled at other locations in western Pennsylvania, New York, and in the Ohio River Valley where oil had been discovered seeping to the surface. The Appalachian Basin was America’s leading oil-producing region at the beginning of the last quarter of the nineteenth century. By 1881 the Bradford Field in western Pennsylvania was producing 77% of global oil output. The principal product of this oil was kerosene, used as lamp oil. Early kerosene was produced with a wide range of volatility and flammability; John D. Rockefeller named his company Standard Oil to highlight the safety and consistency of the kerosene he produced. The Standard Oil Company, begun in Cleveland in 1870, soon dominated the kerosene market in Ohio and the nation. A few decades later, by the beginning of the twentieth century, the Russian Empire once again led the world in oil production and commercial oil extraction was also underway in Sumatra, Persia, Peru, Venezuela, and Mexico in addition to Ohio, Texas, and Southern California.

American oil exploration spread quickly to Kansas, Oklahoma, Arkansas, North Louisiana and East Texas in the 1890s. The Los Angeles Basin began producing oil products in the 1880s and 1890s, but due to the different chemical makeup of California oil, it was less appropriate for kerosene and was used mostly to produce fuel oil and asphalt. In the early years of the twentieth century, California’s Long Beach and Wilmington Oil Fields became the world’s leading producers of oil per acre, leading to the development of the port of Los Angeles as a hub for overseas shipment of oil. In addition to drilling wells on land, oil companies developed both anchored and floating platforms for extracting oil from the sea bed. The Gulf of Mexico is the most explored, drilled, and developed offshore petroleum province in the world. Developed since the end of World War II in 1945, the Gulf of Mexico now produces about 34% of the world’s crude oil and about 25% of the world’s natural gas. The continental shelf off the cost of Texas and Louisiana is dotted with over 4,000 active platforms with 35,000 wells and 29,000 miles of pipeline. But in spite of these new offshore projects, conventional oil discoveries in the lower 48 states peaked in 1930 and production peaked in 1970.

Standard Oil was prosecuted as a monopoly under the Sherman Antitrust Act in 1911 and forced to split into 34 independent operating units. The largest were Standard Oil of New Jersey (which became Exxon), Standard Oil of New York (Mobil), Standard Oil of California (Chevron), Standard Oil of Indiana (Amoco), and Standard Oil of Ohio (Sohio). In addition to the “baby Standards,” there were a small number of international petroleum companies formed in the early years that retain control of a large portion of the industry. These included Royal Dutch Shell, formed in 1907 as a merger of a Dutch and a British company, and the Anglo-Persian Oil Company, now known as British Petroleum (BP), founded in 1909. In 1968 BP bought Sohio and began developing a major oil field discovered in Prudhoe Bay, Alaska. Multi-national petroleum companies like Exxon-Mobil (the two baby Standards merged in 1998 to become the world’s largest oil company) and BP have become increasingly able to project their economic power to shape the politics of the nations where they do business. Effects of this power include the opening of new federal lands (including national parks and nature reserves) to drilling in the Arctic Circle and the minimal penalties assessed against corporations for disasters such as the 11-million gallon Exxon Valdez spill in 1989 or the BP Deepwater Horizon explosion and 210-million gallon spill in 2010.

As multinational petroleum corporations grew, they not only to influenced the politics of the nations in which they operated, but tried to direct the foreign policies of their home nations. When President Lázaro Cárdenas nationalized oil production in Mexico in 1938, oil companies asked the American government to intervene. But Franklin D. Roosevelt was busy fighting against corporate interests trying to undermine the New Deal policies he had implemented to mitigate the Great Depression. He declined to interfere with Mexico’s right to control its subsurface assets, which were a natural continuation of the legal traditions of Spanish America. The corporations had better luck after Iranian Prime Minster Mohammad Mosaddegh decided to nationalize the Anglo-Iranian Oil Company (BP) in 1951. BP got the help of British Prime Minister Winston Churchill to convince US President Harry S. Truman that Mosaddegh had to go. Britain’s MI-6 and the CIA replaced Iran’s elected government with Shah Mohammad Reza Phalavi, who ruled with an iron fist until the Iranian Revolution of 1979. After the Shah’s installation, Iranian oil production jumped from an average of about a million barrels per day in the early 1950s to nearly 6 million barrels daily in the 1970s.

Petroleum is not the only resource that has led corporations to interfere in the political affairs of nations. The Norte Grande region that Chile took from Peru and Bolivia in the War of the Pacific to gain control of nitrate deposits in the Atacama Desert (mentioned in Chapter 8) also contains some of the richest copper deposits on Earth. Chuquicamata is the largest open-pit mine in the world. The nearby Escondida mine is nearly as big, and is the world’s most productive copper mine. In central Chile, about 57 miles south of the capital, Santiago, is the world’s largest underground mine, El Teniente. Copper mining has been a leading industry in Chile throughout the nation’s history, but in the early twentieth century Chilean mines were bought by American investors and the industry became dominated by large US mining conglomerates like Anaconda and Kennecott, owned by the Guggenheim Partners. In the late 1960s, Chile began nationalizing its copper industry, with seizures beginning under a Christian-Democrat coalition government and continuing under the socialist government of President Salvador Allende. Corporate dissatisfaction with the nationalizations led to a CIA-backed coup that resulted in the death of President Allende and the dictatorship of General Augusto Pinochet from 1973 to 1990.

Ironically, Pinochet did not give back the copper mines, and Codelco, Chile’s national copper company, is still the world’s largest supplier. Since the end of the dictatorship and reestablishment of democracy in Chile, foreign companies have been invited to develop mines in parallel with Codelco, and the Escondida mine mentioned earlier is actually owned by an Australian-based multinational, BHP Billiton. Other companies operating mines in Chile include US-based Phelps Dodge and the Japanese zaibatsu Sumitomo. Chile’s economy is now regarded as one of South America’s most stable and prosperous. The nation produces a third of the world’s copper, which accounts for 53% of Chile’s exports. The emergence of China as Chile’s main export partner, purchasing fully a quarter of the country’s exports, has probably helped reduce the influence of US corporations in Chilean internal affairs and may even have helped end the dictatorship that had been widely (if quietly) supported by American diplomats and vocally supported by “free-market” economists like the technocrats of the Chicago School who were key advisors to the Pinochet regime.

National borders have never been particularly effective in preventing natural resources, especially nonrenewable resources like minerals and petroleum, from finding their way to the markets where they are most valuable. Underground treasures like oil, silver, gold, and copper have become the energy and mineral wealth that powers the world economy.

Further Reading

- Bill Carter, Boom, Bust, Boom: The Story About Copper, the Metal that Runs the World, 2013

- Patricia Nelson Limerick, The Legacy of Conquest: The Unbroken Past of the American West, 1987

- Shawn William Miller, An Environmental History of Latin America, 2007

Media Attributions

- Capitulo-CIX by A.Skromnitsky © Public Domain

- Miners at work. by Christophe Meneboeuf © CC BY-SA (Attribution ShareAlike)

- Homestake_works_mine_1889 by John C. H. Grabill © Public Domain

- Ontonagon_Copper_Boulder by Ian Shackleford © CC0 (Creative Commons Zero)

- Carnegie-1903 by Louis Dalrymple © Public Domain

- 1850_Woman_and_Men_in_California_Gold_Rush by Unknown © Public Domain

- Earlyoilfield by Unknown © Public Domain

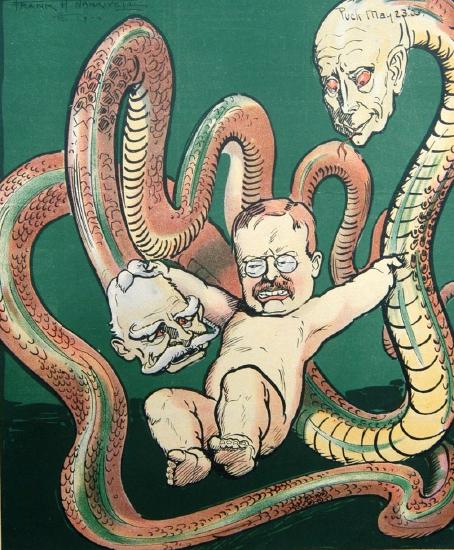

- PuckCartoon-TeddyRoosevelt-05-23-1906 by Frank A. Nankivell © Public Domain

- 2880px-Mina_de_Chuquicamata,_Calama,_Chile,_2016-02-01,_DD_110-112_PAN by Diego Delso © CC BY-SA (Attribution ShareAlike)