6: Economics and Externalities

- Page ID

- 8282

The study of economics as a distinct academic field began at about the same time as the industrial revolution and many of the economic ideas proposed by early writers on the subject, such as Adam Smith, David Ricardo, Friedrich Engels and Karl Marx, are still taken very seriously today. Economics is described as the science of human choice, but unlike other scientists in fields like psychology, economists often claim to be able to extrapolate from numerical data about people’s behaviors (that is, from the records of transactions in markets) to predict the future. And although most of the economic news and analysis we hear seems very dry and statistical, it is important to understand some of the basic philosophical beliefs and assumptions about human nature that stand behind these numbers.

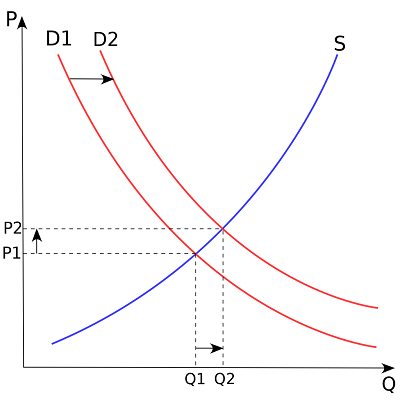

At its most basic level, economics is the study of supply and demand. The classical supply and demand curves of modern economics textbooks go all the way back to Smith and Ricardo. They remain the bedrock of the field, and the first things students learn in high school or college courses. So let’s look at them first.

The first philosophical assumption supporting the supply-demand graph is so obvious that most people, including many economists, don’t even notice it. There are two curves, supply and demand. Where they meet is where the transaction happens: where two players in the market exchange goods and services for money. See the assumption? Two players. Separating the world into producers and consumers is so basic nowadays that it’s difficult to imagine a different way to think about economic relationships. Of course economists understand that a person can be a producer in one transaction (say, as a teacher, a bricklayer, or an office worker) and then be a consumer in the next (at the grocery store or buying a car). But even so, these different activities are generally thought of as being completely separate from each other. What you do to earn a paycheck, for example, is not supposed to influence the brand of breakfast cereal or yogurt you prefer.

This reductive logic makes some sense, since for most of us the paycheck-yogurt relationship is probably pretty tenuous. And seeing that, economists conclude they are just describing reality when they tally up the dollars we spend on particular yogurt brands; that they have accurately described the real world without making any “normative” judgments about it. But as any photographer knows, choosing what to exclude and include when framing an image has a profound effect on its meaning and significance and can completely change the viewers’ understanding of what they see.

Societies like America before the industrial revolution are often described as non-commercial. Historians have argued for generations whether early Americans went through some sort of “Market Transition” as they became more embedded in commerce — and if so, where and when that may have happened. This was one of the areas I studied closely in Graduate School, and I think historians’ ideas about what commercial behavior looks like have changed at least as much as Early Americans’ actual behavior. As we saw at the very beginning of this course, Americans have always bought and sold products in markets. The Spanish Empire exported hundreds of shiploads of gold and silver from its colonies to Europe. The North American colonies depended on financing from Britain to get off the ground at all, and later depended on trade with the West Indies for their survival when the support of their British patrons was cut off by Cromwell’s civil war. Later, western settlers sent grain down rivers or hauled barrels of whiskey over the Appalachian Mountains.

Every sack of flour and barrel of whiskey or salted pork that changed hands in Early America was a market transaction. But what was special about these transactions was that at first they were usually between people who knew each other and had a relationship that extended beyond that moment when the seller’s supply curve and the buyer’s demand curve intersected. In Early America, commercial transactions usually took place in a larger social context. Buyers and sellers were often neighbors. A farmer who sold his grain to the local miller often also bought supplies at the general store the miller ran. And beyond their purely business transactions, they probably saw each other at town meetings, or at the local tavern or church. They probably helped each other build barns and fences, and their children went to school together and occasionally even married. The big change came, as we saw in Chapter 7, when transactions became impersonal and exchanges were more often between strangers than between neighbors and friends. Government inspections were never necessary when your meat came from the butcher down the street whom you had known your whole life. But it was the only thing that prevented Chicago packing corporations from cutting corners and selling bad meat to strangers half a continent away. Similarly, when prices were negotiated between people who had complicated ongoing relationships with one another (especially where people changed roles and were sometimes buyers and at other times sellers), they often reflected more than simply a meeting of supply and demand curves. The economic logic of supply and demand expects buyers to always pay the least they can to acquire a product and sellers to always try to maximize their profits on each transaction. Real transactions were often more complicated, especially where economic relationships were embedded in a larger context of other social interaction.

The other change brought about by the rise of central markets was that not only did buyers and sellers become anonymous strangers to each other, but the products themselves became standardized and undifferentiated. As discussed in Chapter 7, railroad technology made the centralization of production in cities like Chicago and Minneapolis possible. Telegraph technology made it possible to establish national prices for commodities. And mass media allowed central producers like General Mills and Armour to create brands that tried to replace the familiarity and trust that had been part of buying from someone you knew. All these technologies helped concentrate wealth in the centers, as farmers on the periphery often became little more than sources of raw materials. Consumers became increasingly dependent on powerful corporations whose decisions they could have little hope of influencing. One sign of this change, which we have trouble seeing because it is such a regular part of life, is fixed retail pricing. You don’t haggle with the supermarket checkout clerk over the price a box of Cheerios. You take it or leave it. General Mills doesn’t really care whether you buy them or not, as long as the rest of the faceless consumers do; just as they don’t really need the oats from any particular farmer, as long as the rail cars are full when they reach the factory.

Economists consider the independence of these huge corporations an important part of “economies of scale,” which they explain are a good thing because they result in lower costs for the producer, and often (although not always) in lower prices to consumers of the final product. The basic idea is that it’s cheaper to make a million boxes of Cheerios in a huge factory than to make one box of Cheerios in your kitchen. Usually the explanation is that expensive capital equipment and technology is used that makes producing each individual unit less expensive — but only if you’re making enough of them to average the cost of that equipment over a large number of units. But as critics of this logic have pointed out, the real source of savings is often in the raw materials. A single buyer purchasing oats from a hundred thousand farmers clearly has the upper hand in negotiations about price. So the low cost of Cheerios may come partly from the machines used to manufacture them, but it also comes from the corporation’s ability to make the farmer accept a lower price for his oats than he might like to get. This is how profits at the center can be thought of as forced subsidies from the periphery. Technology (and the field of economics itself) tends to make this relationship harder to see by focusing attention on the apparent impartiality of the markets and on the profits achieved in the center.

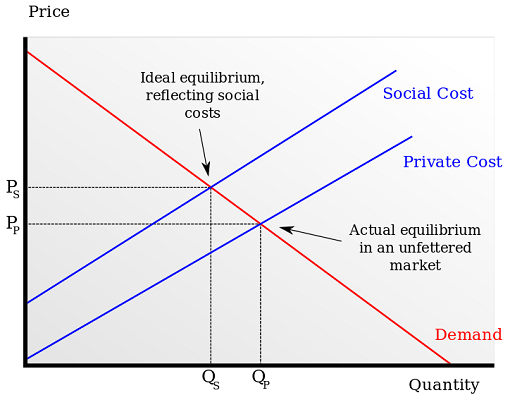

In addition to being a source of cheap raw materials for central processors, the periphery is often a dumping-ground for waste the center chooses not to deal with. Economists so frequently ignore adverse effects of economic transactions when they take place outside of the center of profit that they have a special name for this type of “market failure.” They call it externality. Standard economic textbooks describe externalities as “the costs created by one party or group and imposed on or spilled over onto some other non-consenting party or group.” Economists understand that “When the act of producing or consuming a product creates external costs, an exclusive reliance on private markets and the pursuit of self-interest will result in a misallocation of society’s resources.” In other words, economists understand that you can’t expect people acting in self-interest to work these issues out for themselves. Often the result of ignoring these externalities, economists admit, is that much more of a product will be made than even the economists view as “socially efficient output.”

The introductory economics textbook I’m quoting from (William D. Rohlf, Jr., Introduction to Economic Reasoning, Seventh Edition, 2008) includes a chapter called “Market Failure” that discusses externalities and possible ways of dealing with them. The textbook says that in some cases the externality can be addressed by considering the property rights of the injured party (in a lawsuit of negotiation). This remedy would clearly work best when the injured property was privately owned and the owner had the resources to pursue legal action or other types of arbitration. The textbook also mentions government regulation, but warns that such regulations often specify remedies that are “needlessly expensive” (by what standard? The textbook doesn’t say) and that regulations reduce the incentives for business to solve its own problems. The chapter gives simple examples of “local externalities” with “local remedies” but fails to mention that often the externality happens far from the corporation’s headquarters, where it is less visible but not necessarily more serious. For example. coal from the Appalachian Mountains in West Virginia, Kentucky, and Tennessee to generate electricity that lights the major cities of the East Coast, like New York City. Mountaintop removal destroys habitats and poisons streams and rivers throughout the region. But this externality is not reflected in the cost of electricity to New York City consumers. The fact that the residents of Appalachia who protest for clean water have much less economic clout than the urban-based mining and power companies and their customers, certainly effects the outcome of negotiations over the externality and its remedies.

Critics of our free market economy often claim that large corporations deliberately produce externalities in faraway places where the residents are powerless to object. Global corporations can now choose to work wherever in the world costs are lowest. In effect, they are exporting externalities to the “less developed world” — which in fact has to remain less developed in order to keep the cost of those externalities as low as possible. This is what critics of capitalism mean when they say that the wealth of the center comes at the expense of the periphery. In the past, it was American corporations such as Union Carbide who built factories in places like India where safety regulations were much less stringent and the people had no recourse when avoidable accidents such as the 1984 Bhopal disaster killed 3,800 people and injured 550,000. More recently, the tables have been turned on Americans. An example of this is a current proposal by a global mining conglomerate, GlencoreXstrata, to begin open pit copper mining in national forest land in northern Minnesota. In addition to having been run by a known criminal (pardoned by President Bill Clinton), GlencoreXstrata is notorious for its human rights and environmental record in the “developing world” — and they are planning on treating northern Minnesota like the “developing world.” The proposed mining project would have a lifespan of twenty years, during which the mine would provide profits for the corporation and employment for residents of the region. Afterward the corporation’s proposal admits, the water treatment would would need to be continued for 200 years for the mine and 500 years for the processing plant. But the corporation promises they’re “good for it,” and the EPA, which only a couple of years ago threw out the proposal, is now willing to consider it with no modifications.

The GlencoreXstrata proposal highlights not only the discrepancy in economic power between a Swiss-headquartered global corporation and the residents of a poor rural area, but also the difficulty dealing with economic externalities that happen in the future. Because its calculations are based on decisions people make in response to present circumstances, the field of economics tends to focus solely on what is important right now. Corporations have often been accused (even by friends of business) of being too obsessed with the next quarterly earnings report. But the whole economic system they use to measure themselves is entirely about the present. Economists have almost no way of accurately gauging the present value of an event that may (or may not) happen at some time in the future. Guesses can be made, but they are rarely taken seriously. This makes markets a particularly inappropriate tool for dealing with issues like long-term environmental damage and global climate change. Even if the immediate profit is slim and the potential future problem is catastrophic, in economic reasoning the present overwhelmingly trumps the future. So free markets and economic calculations cannot be relied on to provide long-term solutions.

A final challenge to the way we normally use economics comes from a surprising direction. In the 1980s, decades of liberal economic policy beginning in the New Deal was reversed in America in a political sea-change known as the Reagan Revolution. After nearly fifty years of national economic policy based on the idea that consumer demand drove growth (Keynesian economics), a new generation of economists chose to put the supply side first. Both schools of national macro-economic policy use the same assumptions about impersonal markets and short-term profits, and many of the changes that were made in the 80s were no more than window-dressing. But it’s ironic that the supply-side position rested on a misunderstanding of a radical libertarian economic theory known as the Austrian School of economics.

When Ronald Reagan was asked who his favorite economist was, he regularly answered by proudly naming an obscure European admired by libertarians. Ludwig von Mises was the leader of a splinter group of economists who vehemently opposed state-sponsored economic policies. They were Europeans working during the cold war, so a lot of the Austrians’ criticism was inspired by and directed at the central planning and “command economies” of Russia and Eastern Europe. But libertarians in American believed that any government involvement in the economy basically deranged the ability of the free market to operate efficiently. There are several levels of irony in this story. The first is that in spite of Reagan’s claims that government was the enemy and should stay out of the economy’s way, he presided over the biggest increase in government spending and national debt since the Great Depression. But an even deeper irony is that the supply side economists based their macroeconomic policies on a theory that basically said that macroeconomics was a fraud. Ludwig von Mises’s magnum opus was an economic tome called Human Action. One of the basic principles of Mises’s theory was that economics was only one way of thinking about human choices. There were economic values that could be measured in dollars, Mises said. But there were also esthetic and moral values, and even if they didn’t have a convenient currency to measure them in, these values were important. People did not make decisions, Mises said, based only on money.

Mises’s other principle was even more problematic for modern economists. Not only were economic values just one of several ways people make decisions, Mises said, but they weren’t even consistent. Human Action‘s central point is that value is not objective and constant (like economists need it to be), but subjective and situational. A glass of water, as Mises observed, is worth very little to me when I’m standing in my kitchen. But strand me in the desert for a couple of days and that same glass becomes incredibly valuable. Not only does value depend on circumstances, Mises said, but it is based on too many subjective factors for anyone to add it all up and create an aggregate demand curve. In other words, the basic diagram that the whole field depended on was illegitimate — or at least it was severely limited in ways we don’t normally take into account. Of course, Reagan and his economists were probably unaware of this, since they had undoubtedly claimed von Mises as their patron saint without bothering to read his book!

None of these issues mean that we shouldn’t use economics at all to try to make rational decisions based on the best data we can get. But it’s important to know the limitations of our tools, so we don’t use them where they are not appropriate. We should understand the economics’ basic assumptions and its weaknesses. We should be aware that economic analysis is based not only on numerical data but also on a set of philosophical beliefs about human nature. We should recognize that economics, like technology, tends to put certain members of society at the center, often at the expense of others on the periphery. We should realize that externalities are common and that they are often deliberately hidden or shipped to places where the costs can be controlled. We should understand that economics naturally favors short-term results and tends to ignore long-term consequences (especially when they are hard to value in dollars). Finally, we should admit that even at its best economics is just one tool among many that we can use to make decisions. It is not the only guide for human action.

Further Reading

- Alf Hornborg, The Power of the Machine: Global Inequalities of Economy, Technology, and Environment, 2001

- Ludwig von Mises, Human Action, 1949

- William D. Rohlf, Jr., Introduction to Economic Reasoning, Seventh Edition, 2008